Book a Free Consultation!

✅Builders CFO Program

✅Business Improvement Program

✅Taxation Advice

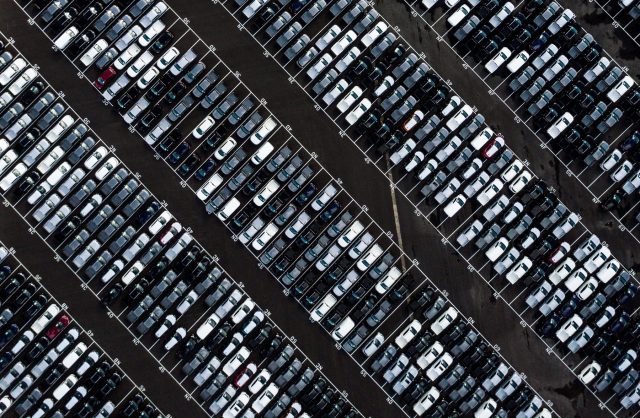

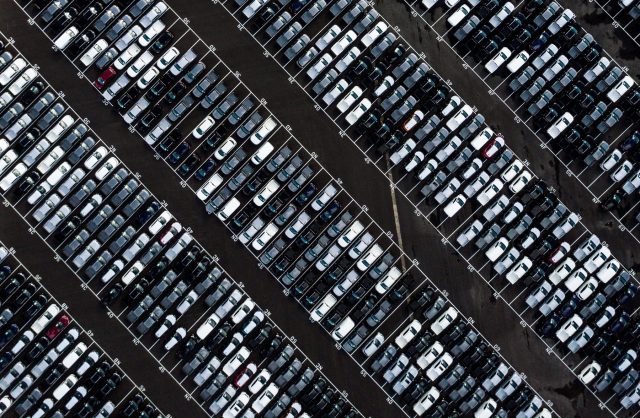

Car fringe benefits tax: the what, how and when

Does your company own motor vehicles? This could be one of your businesses biggest assets, and providing company cars to staff including directors can make you an employer of choice. But with that vehicle comes an employee benefit, increased risk and Fringe Benefits Tax.

With fringe benefits tax being such a complex topic – with exceptions, annual taxation rate changes and different calculation rules – we asked Partner Shaun Borg to take us through the ins and outs.

If you have company cars, a commercial fleet, or are looking into a company car, read on to learn when fringe benefits apply, how to assess what’s right for you, and techniques to reduce tax payments.

When does fringe benefits tax apply to cars?

Fringe benefits tax applies to any non-salary benefits provided to employees. This could be childcare, entertainment, housing or travel allowances (among many more). Essentially, fringe benefits tax (FBT) relates to any lifestyle assets that can be used for personal enjoyment.

While it relates to an employee benefit, you (as the employer) must pay it along with any other company taxes.

According to the Australian Taxation Office, FBT applies to vehicles that are:

- In the company’s name

- A carrying capacity of less than one tonne

- Designed to carry less than nine people

“The reason a company car is liable for FBT is – although owned by the company – it could be used for private use,” explained Partner Shaun Borg. “Therefore, the liability is with you – the employer – and the company must pay the associated tax for its private use.”

However, when it comes to vehicle usage, there are some exceptions – especially when it comes to the industry you work in.

“If you’re a tradie or in construction, your ute is more than just a vehicle to get you to site. It’s for carrying your equipment and supplies, picking up stock. You name it, a tradie usually has to use his vehicle for it. That’s why it’s generally exempt from fringe benefits tax, as it’s required for the job.”

As well as building and construction vehicles, other exceptions include taxi services, couriers and cars used for commercial purposes as well as if the private use is limited to certain situations.

When it comes to car fringe benefits tax, records are key.

Regardless of what the car is used for, how often, or if it’s exempt, records are essential for taxation and auditing purposes. As fringe benefits tax is tax deductible, you’ll also need up-to-date records to support your claim.

“The biggest mistake we see is companies failing to keep records. This could be an invalid log book, no log book at all, or missing documents and invoices,” said Shaun.

Vehicle records required for car fringe benefits tax

The type of records you need are defined by how you calculate your fringe benefits tax (FBT) payments. These records are also required to support any claims (such as deductions), to show how your FBT was calculated, and for auditing purposes.

Below are the current records required, as defined by the Australian Taxation Office.*

| FBT calculation method | Records required | Employee usage declaration required |

| Statutory formula method

Based on car value. |

|

Yes. |

| Operating cost method

Based on car usage. |

|

Yes. |

Even for fringe benefits tax exempt vehicles, an annual employee declaration must also be signed (declaring how much the car is used privately).

“This declaration can often be overlooked, creating havoc when it comes to audits,” warned Shaun.

“If you’re not sure what’s required, our business advisers can take you through the details, providing insight on what’s best for you, records you need to keep, and how often you need to update documents. Working together you will know your responsibilities up front and avoid a sticky (and expensive) situation later on.”

Statutory formula or operation cost method: Which is best?

There are two ways to calculate how much fringe benefits tax you owe: The statutory formula method and the operation cost method.

To choose the right fringe benefit tax method for you, it’s best to assess not only on record requirements but also what provides the lowest taxable value.

“For many people, the statutory method seems the most straightforward. Less records are involved, and you require less from your employee driving the car. However, it can be really costly in the long-run,” said Shaun.

“The statutory method takes the purchase price – including GST – and deems 20% of the value for private use. On an $80,000 car, that could be $16,000. By the time you multiply that by the current FBT rate – which changes annually – and apply a 47% tax rate to the grossed up value, you could be liable for $15,643 in fringe benefits tax. And that’s on an annual basis for the first four years of ownership. After four years of ownership the cost base value of the vehicle is reduced by one third, effectively reducing the fringe benefits tax by one third in year 5.”^

“In comparison, for example, let’s assume your total operating costs of the vehicle (including depreciation and interest) was $20,000 for the year. Your logbook usage may then show the vehicle’s business usage is 50%. Using the operating cost method, the fringe benefits tax will only be $9,777,” explained Shaun.

“In addition, if the running expenses (for example fuel, rego, insurance and servicing) remain consistent for each year of vehicle ownership, the depreciation and interest value still reduce. Your fringe benefit tax? It reduces in year two, to approximately $8,708, and will keep typically reduces every year.”^

How to reduce the amount of fringe benefits tax owed

To uncover ways to reduce your fringe benefit tax payments, it’s key to seek advice from your accountant or business adviser.

“Our business advisers could uncover that switching methods could dramatically reduce the tax you owe,” said Shaun.

“How your vehicles are used may have changed over the last 12 months, which could impact the records you need and how you calculate your FBT. This is why regular check-ins to review your tax position are essential.”

When it comes to reducing fringe benefits tax, Shaun explained that sometimes the best option is to remove company vehicles all together.

“I recently reviewed a client’s tax position and we found that getting rid of the company vehicles would actually be better for them.”

“Instead of providing a company vehicle, it may be simpler to pay an allowance to employers to cover your employee’s work-related car expenses – reducing your liability to maintain records and placing the onus of maintaining records on the employee” said Shaun.

The key to owning company vehicles? Ensure you’re across the business, tax and compliance requirements when it comes to owning company vehicles.

“If you want to provide employee vehicles, that’s great. But know where you stand, the implications, and be aware of the costs. And make sure you’re across the compliance requirements – and so are your employees,” said Shaun.

“That’s where our business advisers really shine – helping you know exactly what tax implications you’re looking at, and what steps you need to be compliant, well in advance. Helping you make more informed business decisions.”

About Shaun Borg

Joining the MEAD Partners family over 14 years ago, Shaun is a business partner and chartered accountant. He’s passionate about helping businesses maximise their potential, providing expert accounting and business advice to reach their business goals. In 2019, Shaun was also named the youngest MYOB accountant of the year. When not crunching the numbers, you’ll find Shaun out in the great outdoors.

Send To Someone