Book a Free Consultation!

✅Builders CFO Program

✅Business Improvement Program

✅Taxation Advice

As a Certified Financial Planner in Melbourne, specialising in retirement planning, one of the most common questions I am asked is – do I have enough for retirement? It is of course a natural question and yet not always straight forward to answer. To help you, we have written this blog, which provides guidance on the variables and considerations to make your transition to retirement in Australia confident and secure.

The age you want to retire will impact how much is enough for retirement.

The first important point to decide is what age you want to retire. The age you retire is most relevant, as it is the starting position that determines how long you will need your funds to last. Australian Bureau of Statistics provides one guideline for expected longevity, using average life expectancy from the age of retirement. At Yield, we prefer to nominate 90 as the age we want funds to last until, to build in some buffer to these numbers also. The longer you want your funds to last in your lifetime, will naturally result in you needing more in most instances, though it will still depend on how much income you desire.

How much retirement income you need, and want, helps determine what is enough.

It can be hard to nominate a target retirement income because it is likely that things will change for you. You may not need two family cars for example, but instead use one. Regular expenses like lunches out at the office, may change to a sandwich at home. But equally, with more free time, you might intend to do some expensive travel or spend more time out with friends and family.

For this reason, it often helps to start by breaking down the expenses you need and those you want. By doing this you can ensure you understand how much is enough to fund the retirement you need, like food on the table, petrol in the car and your lights on, while also understanding the extra amount required to fund the additional things you want that will make your life ideal.

As retirement planners, we will always encourage our clients to consider what their best retirement lifestyle looks like, to see if this can be achieved financially and by us understanding what a person needs and wants, it allows us to help them find an appropriate compromise when this is necessary. After all, you have worked hard and want to live your best life, but at the same time, you need to know you are secure.

ASFA provides annual data on the average retirement income in Australia

A helpful guide for the average retirement income needs of Australian’s is the data published by the Association of Superannuation Funds of Australia (ASFA). The latest data was released in June 2023 and came out with its annual median retirement income figures needed in Australia, which were:

They define a modest lifestyle as better than simply being on the Age Pension, but still only able to afford basic activities, while a comfortable retirement lifestyle allows retirees to participate in a broad range of hobbies and have a good standard of living by being able to afford household goods, private health insurance, a decent car, good clothes etc.

In today’s dollars, could you see yourself retiring on any of these amounts? Considering your needs, relative to this average, provides a different lens to determine what level of income is going to be enough for your retirement objectives.

Steps you can take now to ensure you have enough for retirement

Some of the things you should have in place at this point in your life to get you organised and on target for a comfortable retirement that is on your terms include:

- Have a clear budget and savings plan

- Develop an investment strategy that gets your money working for you

- Embrace superannuation and start to grow it for your retirement

- Have a clear debt reduction strategy

- Have a well thought out risk management strategy

It is my experience that very few people are in the fortunate position that they do not have to make compromises, to achieve the quality of retirement that they want. Anecdotally, about 5 out of 10 of our clients make compromises and as a general statement I would say they are better off financially than average.

The reasons for this is varied but not limited by the fact that it quite often follows that if you earn more in your working life, you have an expectation of a higher income in retirement as well.

Determining the lump sum you need to retire comfortably

As a simple example, a 40 year old today, wanting a retirement income of $80k in today’s dollars at age 65, will need superannuation of around $1,300,000, invested with a growth spread of investments to achieve it. This includes potential Centrelink, and is based on the money smart calculator, provided by the Victorian Government.

Take the time now to review how much is enough for your retirement, to achieve the income that you want.

Boost your Age Pension entitlement strategically where you can.

There are strategies to potentially increase Age Pension entitlement, that can underpin some of your retirement income needs. The Age Pension in Australia works on two tests, the assets test and the income test. When Centrelink apply these tests, they use the one that creates the lower pension outcome for you. In this way it is a simple and fair system, to benefit those that really need it, however there are strategies that can help.

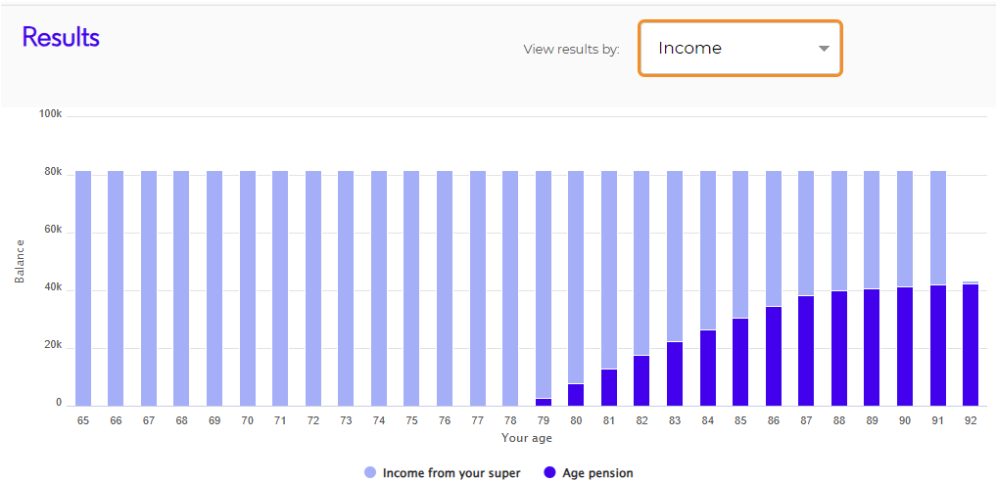

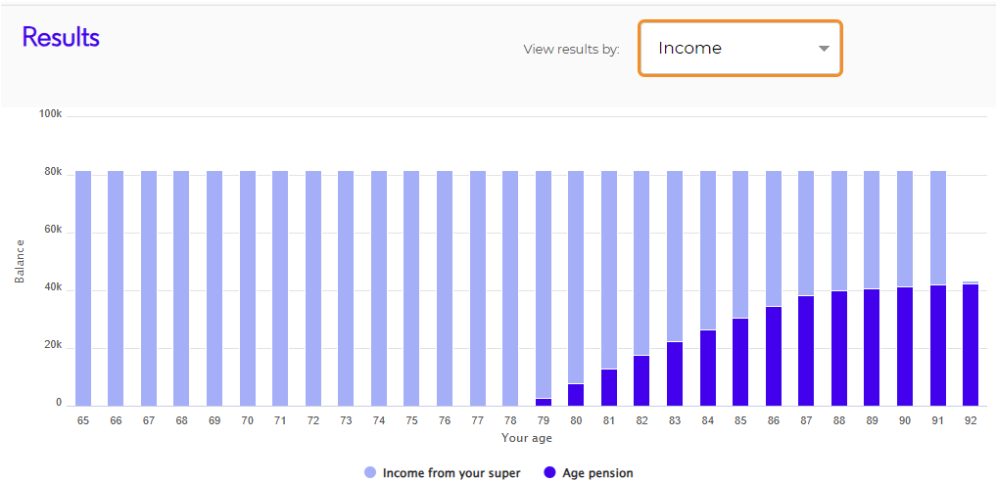

Below is the graph I produced from Money smart, for the previous example, being a person wanting $80,000 p.a. to age 90. This shows when age pension starts to be payable and then how it grows to become a larger sum of income, as the super balance drops.

Three examples of strategies we may consider that could improve the Age pension outcome include:

- Invest more in a younger spouses super fund and leave in accumulation

- Invest in super products with Centrelink benefits like annuities and innovative retirement income streams

- Invest more in the principle place of residence

Each of these examples are only appropriate on a case by case basis, but they represent some of the strategies that can help ensure you have enough for retirement, by underpinning your position with more age pension.

Plan now so you have enough for retirement

My best advice to you now is that if you want to be able to maintain the lifestyle you enjoy today, get your ducks lined up from here and steadily chip away with purpose at achieving the retirement you desire.

Knowing how you are travelling financially to this point, will determine what the best next step is for you, so if you don’t feel like some of the elements I’ve outlined above are being addressed as well as they could be at the moment, then start there.

Conversely if you are feeling in control and well positioned at this point, it is worth considering more complex options, including a Self-Managed Super Fund (SMSF) for example or investing within a Trust or Company or simply refocusing your strategy to have lower risk to shore up your position.

Yield Financial Planning Is Here To Help

Hopefully this blog has provided you some insight on how you can help ensure you have enough funds for your retirement, but to get help, contact the team at Yield Financial Planning, and we can help you find some clarity.

About the author

James McFall is the founding director of Yield Financial Planning. He has been advising clients on achieving secure retirement for more than 20 years. He holds a Master of Commerce (Financial Planning), Graduate Certificate of Commerce (Financial Planning) and a Diploma of Financial Advising. He is a Certified Financial Planner (CFP®), has a Certificate IV in Property Services (Real Estate), is SMSF accredited and is a passionate advocate of the Financial Planning industry. What James loves most about Financial Planning is the satisfaction of helping our client’s transition to retirement with confidence.

Send To Someone